Calculating sales tax in Pakistan is straightforward. Multiply the price of goods or services by the applicable tax rate.

Understanding sales tax is vital for businesses and consumers. In Pakistan, sales tax is a key part of the tax system. It affects the final price of goods and services. Knowing how to calculate it helps you stay compliant with laws.

It also aids in budgeting and financial planning. This guide will walk you through the steps of calculating sales tax in Pakistan. You’ll learn about the current tax rates and how to apply them. By the end, you’ll have the knowledge to handle sales tax with confidence. Let’s get started!

Credit: www.youtube.com

Sales Tax Basics

Understanding how to calculate sales tax in Pakistan is crucial for businesses and consumers alike. Sales tax basics help in grasping the fundamental concepts required for accurate tax calculation. Familiarity with sales tax ensures compliance with financial regulations and avoids potential penalties. Let’s dive into the essential aspects of sales tax in Pakistan.

What Is Sales Tax?

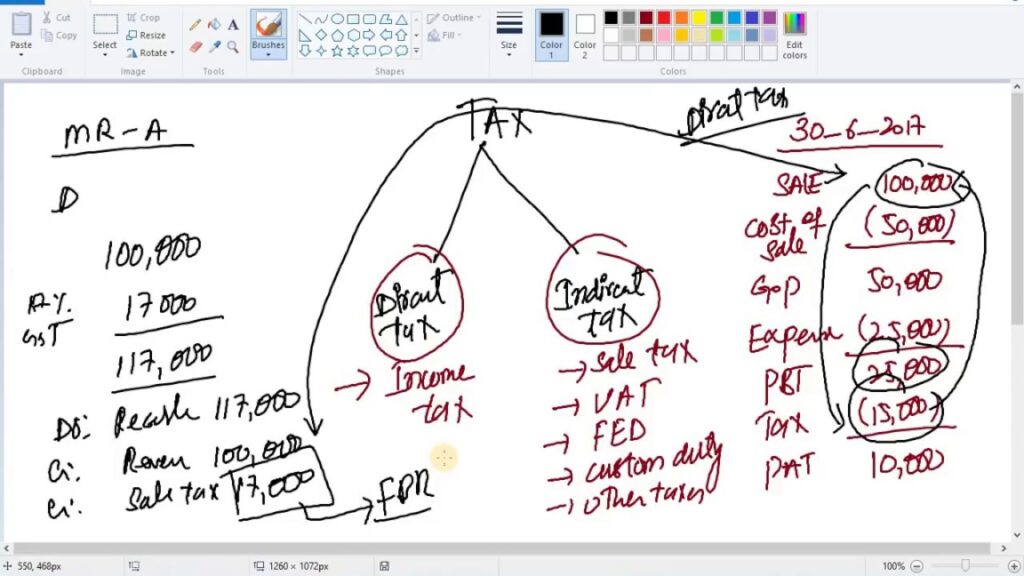

Sales tax is a consumption tax imposed by the government on the sale of goods and services. In Pakistan, the sales tax is often referred to as Value-Added Tax (VAT). This tax is collected at various stages of production and distribution. The end consumer ultimately bears the cost.

Here are some key points about sales tax:

- Revenue Generation: Sales tax is a significant source of revenue for the government.

- Sales Tax Rates: These vary depending on the type of goods or services.

- Value-Added Tax: Commonly known as VAT, this tax is levied at each stage of production.

To calculate sales tax in Pakistan, follow these steps:

- Identify the applicable sales tax rate for the product or service.

- Determine the sale price of the item excluding tax.

- Multiply the sale price by the sales tax rate.

- Add the calculated tax to the sale price to get the total cost.

For example, if a product costs PKR 1,000 and the sales tax rate is 17%, the calculation would be:

| Sale Price | PKR 1,000 |

|---|---|

| Sales Tax Rate | 17% |

| Sales Tax Amount | PKR 170 |

| Total Cost | PKR 1,170 |

Importance Of Sales Tax

Sales tax plays a vital role in the economy. It ensures a steady revenue stream for the government, which is crucial for public services and infrastructure. Here are some reasons why sales tax is important:

- Revenue Generation: Sales tax provides a significant portion of the government’s budget.

- Business Taxation: It ensures businesses contribute fairly to the economy.

- Tax Compliance: Proper sales tax calculation and collection promote compliance with Pakistan tax laws.

Businesses must register for sales tax to comply with financial regulations. Sales tax registration is mandatory for businesses exceeding a certain turnover threshold. This registration helps in maintaining transparency and accountability in the business sector.

Moreover, understanding VAT in Pakistan is essential for accurate sales tax calculation. Businesses need to be aware of the specific rates and exemptions applicable to different products and services. This knowledge helps in avoiding errors and potential legal issues.

Sales tax also encourages consumer responsibility. By paying sales tax, consumers contribute to the nation’s development. This tax supports various public services, including education, healthcare, and infrastructure projects.

In summary, sales tax is a crucial element of Pakistan’s financial system. Its proper calculation and collection ensure compliance with tax laws and support the country’s economic growth.

Sales Tax Rates In Pakistan

Understanding how to calculate sales tax in Pakistan is crucial for businesses and consumers alike. The sales tax rates in Pakistan vary depending on the region and type of product or service. This guide will help you understand the current tax rates and the variations by region. Knowing these details ensures proper business tax compliance and accurate sales tax calculation.

Current Tax Rates

The sales tax rate in Pakistan is primarily governed by the Federal Board of Revenue (FBR). The general sales tax (GST) rate is set at 17%. This rate applies to most goods and services across the country.

Here’s a quick summary of the current tax rates:

- General Sales Tax (GST): 17%

- Reduced Rates for certain essential goods, such as agricultural products, ranging from 5% to 10%

- Standard exemptions on basic food items and health-related goods

For businesses, it is important to stay updated with the latest tax regulations. This ensures accurate sales tax return filing and adherence to the Pakistan tax system. The Federal Board of Revenue periodically updates the tax rates and exemptions, so regular checks on their website or consulting with a tax advisor is recommended.

Here’s a table summarizing the general sales tax rates:

| Type of Goods/Services | Sales Tax Rate |

|---|---|

| General Goods and Services | 17% |

| Agricultural Products | 5% – 10% |

| Basic Food Items | Exempt |

| Health-Related Goods | Exempt |

Variations By Region

Sales tax rates in Pakistan can vary significantly by region. Each province has the authority to set its own tax rates for specific goods and services. This leads to regional tax differences that businesses must consider.

The four provinces in Pakistan – Punjab, Sindh, Khyber Pakhtunkhwa, and Balochistan – have their own provincial tax rates. Here is a breakdown:

- Punjab: Generally follows the federal GST rate of 17%, with some regional exemptions.

- Sindh: Sales tax on services is set at 13%, while goods follow the federal GST rate.

- Khyber Pakhtunkhwa: Similar to Sindh, with a 15% sales tax on services.

- Balochistan: Aligns closely with the federal rate, but specific local exemptions may apply.

Businesses must be aware of these provincial tax rates to ensure proper sales tax calculation and compliance. For example, if a business operates in multiple provinces, it must adjust its sales tax return filing according to each region’s specific rates.

Below is a table summarizing the provincial tax rates:

| Province | Goods | Services |

|---|---|---|

| Punjab | 17% | 17% |

| Sindh | 17% | 13% |

| Khyber Pakhtunkhwa | 17% | 15% |

| Balochistan | 17% | 17% |

Understanding these regional differences is key for businesses to maintain accurate records and avoid penalties. Always consult local tax authorities for the most current information on provincial tax rates.

Calculating Sales Tax

Understanding how to calculate sales tax in Pakistan is crucial for businesses and consumers alike. Calculating sales tax helps ensure tax compliance in Pakistan and accurate financial planning. This guide will walk you through the sales tax calculation formula and provide a detailed step-by-step example.

Formula For Calculation

The sales tax calculation formula is straightforward. You need to know the sales tax percentage set by the government, which can vary by product or service. Here’s how you can calculate it:

- Identify the sales tax rate applicable to your product or service. This can be found in the tax laws in Pakistan.

- Determine the price of the product or service before tax.

- Multiply the price by the sales tax rate to find the amount of tax.

- Add the tax amount to the original price to get the total price.

Here’s a basic formula:

Sales Tax Amount = (Price Before Tax) x (Sales Tax Rate) Total Price = Price Before Tax + Sales Tax Amount

For example, if the sales tax rate is 17% and the price of a product is Rs. 1,000:

| Price Before Tax | Sales Tax Rate | Sales Tax Amount | Total Price |

|---|---|---|---|

| Rs. 1,000 | 17% | Rs. 170 | Rs. 1,170 |

Using this formula ensures accurate consumer tax calculations and helps with sales tax return filing.

Step-by-step Example

Let’s go through a step-by-step example to make the process clear. Assume you run a business selling electronics, and you need to calculate the sales tax for a laptop priced at Rs. 50,000. The sales tax rate for electronics is 17%.

- Determine the price before tax: Rs. 50,000.

- Identify the sales tax rate: 17%.

- Calculate the sales tax amount:

Sales Tax Amount = Rs. 50,000 x 0.17 = Rs. 8,500 - Add the tax amount to the price before tax:

Total Price = Rs. 50,000 + Rs. 8,500 = Rs. 58,500

Here’s a table summarizing the example:

| Price Before Tax | Sales Tax Rate | Sales Tax Amount | Total Price |

|---|---|---|---|

| Rs. 50,000 | 17% | Rs. 8,500 | Rs. 58,500 |

This simple example illustrates how to calculate sales tax accurately. Knowing the sales tax rates in Pakistan and applying the sales tax calculation formula ensures proper business taxation and aids in vat in Pakistan. This method helps businesses and consumers understand calculating GST in Pakistan.

Sales Tax Invoices

Sales tax invoices are a key part of the tax filing process in Pakistan. These invoices act as evidence of transactions for both the seller and the buyer. Understanding how to prepare these invoices correctly is essential for accurate sales tax calculation in Pakistan. Let’s explore the requirements for these invoices and common mistakes to avoid.

Requirements For Invoices

Creating a compliant sales tax invoice in Pakistan involves adhering to specific guidelines set by the Federal Board of Revenue (FBR). Here are the essential elements that every sales tax invoice must include:

- Invoice Number: Each invoice must have a unique sequential number.

- Date of Issue: The date when the invoice is issued.

- Seller’s Details: Name, address, and Sales Tax Registration Pakistan number.

- Buyer’s Details: Name, address, and, if applicable, the buyer’s registration number.

- Description of Goods/Services: A detailed description of the goods or services sold.

- Quantity and Price: The quantity of goods and the price per unit.

- Total Value: The total value of the goods or services before tax.

- Sales Tax Rate: The applicable sales tax rate as per Sales Tax Rates Pakistan.

- Sales Tax Amount: The total sales tax calculated on the sale.

- Total Amount Payable: The total amount payable, including tax.

Here is a sample format for a sales tax invoice:

| Field | Description |

|---|---|

| Invoice Number | Unique sequential number |

| Date of Issue | Date of issuance |

| Seller’s Details | Name, address, Sales Tax Registration Pakistan number |

| Buyer’s Details | Name, address, registration number |

| Description of Goods/Services | Detailed description |

| Quantity and Price | Quantity of goods, price per unit |

| Total Value | Total value before tax |

| Sales Tax Rate | Applicable sales tax rate |

| Sales Tax Amount | Total sales tax amount |

| Total Amount Payable | Total amount including tax |

Common Mistakes

Many businesses make common sales tax mistakes when preparing invoices. Avoiding these can ensure better tax compliance in Pakistan:

- Missing Information: Omitting key details like the buyer’s information or sales tax amount can lead to issues during the tax filing process Pakistan.

- Incorrect Sales Tax Rates: Using wrong sales tax rates can result in underpayment or overpayment of taxes. Always check the latest Sales Tax Rates Pakistan.

- Non-Sequential Invoice Numbers: Invoice numbers should follow a sequential order. Random or duplicate numbers can cause confusion during audits.

- Incorrect Tax Calculations: Mistakes in sales tax calculation Pakistan can lead to discrepancies. Double-check your calculations.

- Failure to Issue Invoices: Not issuing invoices for every taxable sale can lead to non-compliance and penalties.

Reviewing your invoices regularly can help in identifying and correcting these common mistakes. This ensures accurate tax compliance Pakistan and smoothens the tax filing process.

Filing Sales Tax Returns

Calculating sales tax in Pakistan involves understanding the tax rates, exemptions, and filing requirements. Filing sales tax returns is crucial for tax compliance in Pakistan. It ensures businesses adhere to the Pakistan tax system regulations. This process requires accurate documentation and timely submissions to avoid penalties. Below, we discuss the key aspects of filing sales tax returns, focusing on filing frequency and required documentation.

Filing Frequency

Understanding the filing frequency is essential for the tax filing process. The frequency of filing sales tax returns in Pakistan depends on the business type and size. Generally, businesses are required to file sales tax returns monthly. Here are the key points to note:

- Monthly Filing: Most businesses need to file sales tax returns by the 15th of the following month.

- Quarterly Filing: Some small businesses may be eligible for quarterly filing.

- Annual Filing: Rarely, certain exemptions allow for annual filing.

Late submissions can result in penalties, making timely filing crucial. The sales tax rates and VAT in Pakistan must be accurately calculated and reported. This ensures the business remains compliant with the Pakistan tax system.

Here’s a table summarizing the filing frequency:

| Business Type | Filing Frequency | Deadline |

|---|---|---|

| Regular Business | Monthly | 15th of the following month |

| Small Business | Quarterly | 15th of the month following the quarter |

| Exempt Business | Annual | End of the fiscal year |

Required Documentation

Documentation for sales tax is vital for accurate tax return filing. The Pakistan tax system mandates specific documents to be submitted. These documents include:

- Sales Invoices: Detailed invoices of all sales transactions.

- Purchase Invoices: Proof of purchases to calculate input tax.

- Tax Calculation Sheets: Sheets showing the detailed calculation of sales tax rates.

- Sales Tax Exemption Certificates: If applicable, certificates proving eligibility for exemptions.

- Bank Statements: Statements validating financial transactions.

Maintaining these documents ensures tax compliance in Pakistan. It supports accurate sales tax calculation and helps avoid errors during the tax filing process. Here’s a breakdown of the required documentation:

| Document | Purpose |

|---|---|

| Sales Invoices | Record of sales transactions |

| Purchase Invoices | Proof of input tax |

| Tax Calculation Sheets | Details of tax calculations |

| Sales Tax Exemption Certificates | Proof of exemption eligibility |

| Bank Statements | Validation of financial transactions |

Tax return filing requires diligence in maintaining these documents. Accurate documentation ensures compliance with GST in Pakistan regulations and smoothens the tax filing process.

Common Sales Tax Exemptions

Calculating sales tax in Pakistan can seem complicated, but understanding common exemptions can make it easier. Some goods and services are not subject to sales tax. Knowing these exemptions helps businesses and consumers save money. This section covers the goods and services that are exempt from sales tax and the eligibility criteria for these exemptions.

Exempt Goods And Services

Not all goods and services in Pakistan are subject to sales tax. Some items are exempt due to their nature or importance. Here are some commonly exempt goods and services:

- Basic Food Items: Milk, bread, and rice are not taxed to keep essential foods affordable.

- Educational Services: Schools and universities do not pay sales tax on educational services and materials.

- Healthcare Services: Hospitals, clinics, and medical services are tax-exempt.

- Religious Services: Goods and services provided by mosques and other religious institutions.

These exemptions help reduce the financial burden on essential services and goods, making them more accessible to the general public. Below is a table summarizing the exempt goods and services:

| Category | Examples |

|---|---|

| Basic Food Items | Milk, Bread, Rice |

| Educational Services | Schools, Universities |

| Healthcare Services | Hospitals, Clinics |

| Religious Services | Mosques, Religious Institutions |

Eligibility Criteria

To qualify for sales tax exemptions, certain criteria must be met. Understanding these criteria ensures compliance with tax laws. Here are the key eligibility factors:

- Type of Goods or Services: Only specified goods and services are exempt. Check the list to see if your product qualifies.

- Registered Entities: Some exemptions apply only to registered entities. For example, educational institutions must be registered with relevant authorities.

- Usage Purpose: The purpose of the goods or services can determine eligibility. For instance, goods used for educational purposes may be exempt.

Meeting these criteria is essential for claiming exemptions. Below is a detailed look at each factor:

Type of Goods or Services: Goods like fresh vegetables and fruits are exempt, but processed foods may not be. Verify if your product is on the exempt list.

Registered Entities: Entities must be registered with the Federal Board of Revenue (FBR) or relevant authorities. Schools, hospitals, and religious institutions must have proper registration.

Usage Purpose: The intent behind using goods or services matters. Goods used in educational or healthcare settings usually qualify for exemptions. For instance, books for school libraries are exempt, but books for commercial sale may not be.

Understanding these criteria helps businesses and individuals correctly apply for sales tax exemptions.

Penalties For Non-compliance

Calculating sales tax in Pakistan is essential for businesses to stay compliant with Pakistan tax laws. Failing to do so can lead to severe penalties for non-compliance. Understanding these penalties is crucial for avoiding financial setbacks and ensuring smooth business operations.

Consequences Of Late Filing

Late filing of sales tax returns can result in significant penalties. The Pakistan tax laws are strict about timely submission. Here’s what businesses need to know:

- Late filing fees: Companies must pay a fixed amount for each day the tax return is delayed.

- Interest on overdue tax: Additional interest is charged on the unpaid tax amount.

- Penalties for late payment: If the tax is not paid within the stipulated time, further penalties may apply.

The table below summarizes the potential penalties:

| Type of Penalty | Description | Amount |

|---|---|---|

| Late Filing Fee | Charged per day after the deadline | Up to PKR 5,000 |

| Interest on Overdue Tax | Applied to unpaid tax amount | 10% per annum |

| Penalties for Late Payment | Additional fine on delayed payment | Varies based on delay |

These penalties emphasize the importance of meeting tax filing deadlines. Businesses must prioritize timely submission to avoid these costly consequences.

Avoiding Common Pitfalls

To ensure compliance and avoid penalties, businesses should be aware of common tax mistakes. Here are some tips:

- Know the deadlines: Mark important dates for tax filing to avoid late submission.

- Understand taxable goods and services: Ensure accurate classification of goods and services for sales tax calculation.

- Keep accurate records: Maintain detailed records of transactions to support your sales tax return.

- Use reliable software: Invest in tax filing software that aligns with Pakistan tax laws.

- Seek professional help: Consult tax professionals for guidance on VAT in Pakistan and other compliance issues.

Businesses can also implement revenue generation strategies that align with tax compliance. This proactive approach ensures smooth operations and reduces the risk of penalties.

Accurate sales tax calculation is key to avoiding penalties for non-compliance. By understanding the common pitfalls and taking preventive measures, businesses can ensure they meet tax obligations efficiently and on time.

Credit: www.extendoffice.com

Resources For Businesses

Understanding how to calculate sales tax in Pakistan is crucial for businesses. It ensures compliance with local regulations and helps in managing financial obligations effectively. There are various resources available that simplify this process, making it easier for businesses to stay updated with sales tax regulations and compute their tax liabilities accurately.

Government Websites

Government websites offer a wealth of information on Sales Tax Regulations Pakistan. These sites provide guidelines, updates, and detailed information on provincial sales tax and VAT in Pakistan. Here are some key resources:

- Federal Board of Revenue (FBR): The official website of FBR is a primary source for understanding sales tax rates in Pakistan. It includes tax laws, updates on regulations, and guides for Business Tax Compliance.

- Sindh Revenue Board (SRB): This site is essential for businesses operating in Sindh. It provides information on Provincial Sales Tax specific to the region.

- Khyber Pakhtunkhwa Revenue Authority (KPRA): KPRA’s website offers details on tax rates and compliance for businesses in Khyber Pakhtunkhwa.

- Punjab Revenue Authority (PRA): For businesses in Punjab, PRA’s website is a vital resource for understanding local sales tax regulations.

These websites also provide downloadable forms, filing procedures, and contact information for further assistance. Regular visits to these sites can help businesses stay informed about changes in Sales Tax Rates Pakistan and other relevant updates.

Useful Tools And Calculators

Various online tools and calculators assist in Calculating Tax Liabilities. These resources simplify the process of computing sales tax, ensuring accuracy and efficiency. Some popular tools include:

| Tool | Description |

|---|---|

| Pakistan Tax Calculator | An easy-to-use tool for calculating sales tax and other taxes. It helps businesses quickly determine their tax liabilities. |

| Tax Calculator PK | This tool provides detailed calculations for sales tax, income tax, and more. It’s useful for businesses and individuals alike. |

These calculators are designed to handle complex tax calculations and provide accurate results. They support various tax types, including VAT in Pakistan and provincial sales tax.

Besides these calculators, many accounting software packages include built-in features for Sales Tax Calculation Pakistan. These tools integrate sales tax computation into broader financial management systems, streamlining the process for businesses.

Using these Sales Tax Online Tools ensures that businesses can efficiently manage their tax responsibilities without spending excessive time on manual calculations. This enhances overall productivity and helps maintain compliance with local tax laws.

Credit: pakistancustoms.net

Frequently Asked Questions

How Is Sales Tax Calculated In Pakistan?

Sales tax in Pakistan is calculated as a percentage of the sale price of goods and services. The standard rate is 17%.

How Do You Calculate Sales Tax Formula?

To calculate sales tax, multiply the purchase price by the sales tax rate. For example, $100 purchase with 8% tax: $100 x 0. 08 = $8.

How To Calculate 18% Tax?

To calculate 18% tax, multiply the amount by 0. 18. For example, $100 x 0. 18 = $18.

How To Calculate Tax In Pakistan?

Calculate tax in Pakistan by identifying your income slab. Apply the corresponding tax rate from the Federal Board of Revenue’s tax table.

Conclusion

Calculating sales tax in Pakistan is simpler than it seems. Understand the local tax rates first. Use the formula shared in this guide. Multiply your total sale by the tax rate. Add the result to the original amount. This gives you the final price.

Always keep updated with any tax changes. Knowing how to calculate sales tax helps in better financial planning. Your business stays compliant, avoiding penalties. So, practice these steps and manage sales tax smoothly.